🗓️ The Ticker Talk: December 15th Week Ahead

A Data Deluge and Global Central Banks Set the Stage for Year-End Volatility

The final full trading weeks of the year are upon us, and the financial calendar is packed. After last week’s domestic central bank moves, the focus shifts globally, while a crucial run of delayed U.S. economic data—including the jobs report and inflation—will finally hit the wire, offering a critical look at the state of the consumer and the labor market. Investors should prepare for a high-volatility, event-driven week.

🏛️ Central Banks & Economic Data: The Global Showdown

While the U.S. Federal Reserve is in a quiet period, its international peers will dominate the monetary policy headlines, with the potential for significant currency and market impacts.

Global Central Bank Bonanza: The European Central Bank (ECB) and the Bank of England (BoE) are widely expected to issue their latest rate decisions on Thursday.1 Consensus favors the ECB holding rates steady, while the BoE is under pressure to deliver a quarter-point cut, though a recent uptick in UK inflation could complicate that. Most notably, the Bank of Japan (BoJ) meets on Friday, with high anticipation of a potential rate hike, a move that would signal an end to negative interest rates and could cause significant volatility in the Yen and global bond markets.2

The U.S. Data Catch-Up: A series of crucial U.S. releases, delayed due to recent government funding issues, will hit the wire:3

Jobs Report (Tuesday): Both October and November Nonfarm Payrolls will be released.4 The market will be laser-focused on the November figures, with expectations for a modest gain in payrolls and the unemployment rate to hold around 4.4%.5 Wage growth will also be key to the inflation narrative.

Retail Sales (Tuesday): Delayed October retail sales will be released.6 A disappointing number would raise concerns about the resilience of the U.S. consumer ahead of the holidays.

Consumer Price Index (CPI) (Thursday): The November inflation reading is expected to show both headline and core CPI remaining sticky, potentially around 3.2% year-over-year.7 This reading will directly influence Fed official rhetoric heading into the new year.

Other Key Data: U.S. Manufacturing PMIs (Empire State, Philadelphia Fed) and housing market data will also be released, providing a broader picture of economic health.8

📈 Stock Market Outlook: Defensive Selectivity

Market commentary following last week’s Fed rate adjustment suggests a risk of “bear steepening,” where long-term yields rise despite a short-term rate cut.9 This indicates that the bond market is pricing in either sticky inflation or increasing credit risk, which is historically a red flag for the broader economy.

Divergence is Key: Financial stocks (often tracked via the XLF ETF) are under pressure, which is unusual in a steepening curve environment.10 This signals a concern for credit quality.

Tech Sanctuary: Capital is forecast to flow back into high-growth, high-liquidity segments, particularly the AI-driven technology sector, as investors seek “fortress” stocks like NVIDIA (NVDA) that can outrun cyclical headwinds.11

Undervalued Sectors: From a longer-term valuation perspective, analysts are pointing to opportunities in Real Estate (especially defensive subsectors like healthcare and wireless towers), as well as selective names in Energy and Technology (including some mega-cap AI leaders and cybersecurity).12

Please take a quick moment to consider subscribing.

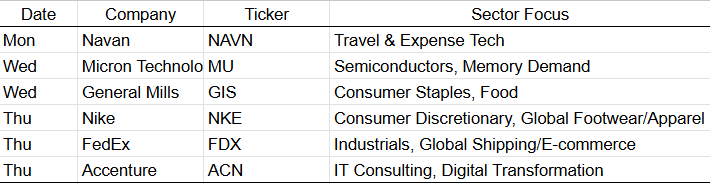

💰 Earnings Reports: Consumer and Tech in Focus

While the bulk of earnings season is behind us, this week features high-profile reports from companies that are bellwethers for consumer spending and critical technology segments.

🪙 Crypto Corner: Bitcoin Range Breakout Looms

The crypto market is entering a pivotal technical phase as the year winds down.

Technical Resistance: Bitcoin (BTC) has seen its recovery stall at a key technical resistance zone, with its December trading range firmly intact.13

Guidance Ahead: Traders are looking for a clear breakout above or below this range to define the trend into year-end. A failure to hold support levels could trigger a deeper decline, while a sustained break above overhead resistance could reignite the recent uptrend. The overall outlook remains technically focused on the next major move.

Bottom Line: This week is a critical crossroads. Global central bank decisions and a flood of delayed U.S. economic data will likely test investor resolve and define the final market posture going into the holidays.

Thank you for reading.