ICYMI: Israel, Iran, and it's affect on oil.

Rising tensions in the Middle East are raising concerns about supply disruptions.

A shadow war that has simmered for decades has erupted into open conflict, sending shockwaves across the Middle East and roiling global markets. The recent direct military exchanges between Israel and Iran mark a perilous new chapter in their long-standing animosity, with significant implications for the global economy, particularly the volatile oil markets. This special report from The Ticker Talk will recap the rapidly unfolding events, delve into the market repercussions, and explore the complex geopolitical chess match.

Timeline of a the Tense Weekend

The situation escalated dramatically starting on Friday, June 13, 2025, shattering the fragile semblance of regional stability.

Friday, June 13, 2025: Israel launches a series of pre-dawn airstrikes against multiple targets within Iran. Israeli officials state the operation targeted Iran's nuclear program infrastructure and key military installations. Reports emerge of significant damage to facilities in Isfahan and Natanz, as well as the targeting of senior Iranian military personnel.

Saturday, June 14, 2025: Iran retaliates, launching a substantial barrage of ballistic missiles and drones aimed at strategic locations within Israel. While Israel's multi-layered air defense system, including the Iron Dome, intercepted a significant number of the projectiles, some missiles did get through, causing damage and casualties.

Sunday, June 15, 2025: The exchange of fire continues, with both sides demonstrating a clear resolve to strike back. Israel conducts further sorties over Iran, while Iran vows a "crushing" response to any further aggression. The international community issues urgent calls for de-escalation, fearing a wider regional conflagration.

The Specter of a Widening Conflict and the Oil Market's Jitters

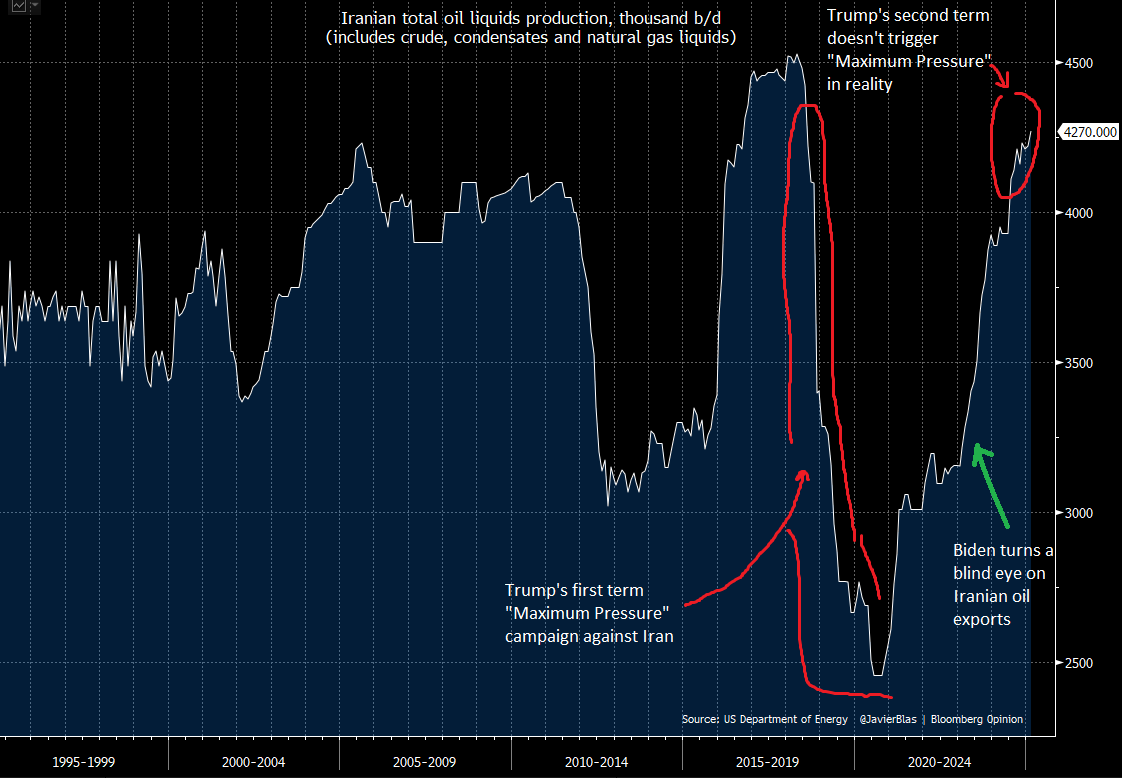

The immediate impact of the hostilities was felt in the global oil markets. Brent crude, the international benchmark, surged by over 5% in the initial hours of trading following the first reports of Israeli strikes. This knee-jerk reaction reflects deep-seated fears of a disruption to the flow of oil from the Middle East, a region that accounts for a substantial portion of global supply. Iran currently produces around 4% of global supply.

The primary concern for the oil market is the potential for the conflict to spill over and impact critical shipping lanes, particularly the Strait of Hormuz. This narrow waterway is a chokepoint through which about a fifth of the world's oil supply passes. Any attempt by Iran to close or disrupt traffic in the Strait would send oil prices skyrocketing, potentially triggering a global energy crisis and tipping fragile economies into recession.

While the immediate spike has seen some stabilization as traders assess the situation, a risk premium is now firmly embedded in the price of oil. The trajectory of energy prices in the coming weeks and months will be almost entirely dependent on the next moves by Israel and Iran. A de-escalation, however fragile, could see prices recede. Conversely, a further escalation, or attacks on energy infrastructure in either country or their neighbors, could see prices climb to levels not seen in over a decade.

The Mysterious Cargo from the East

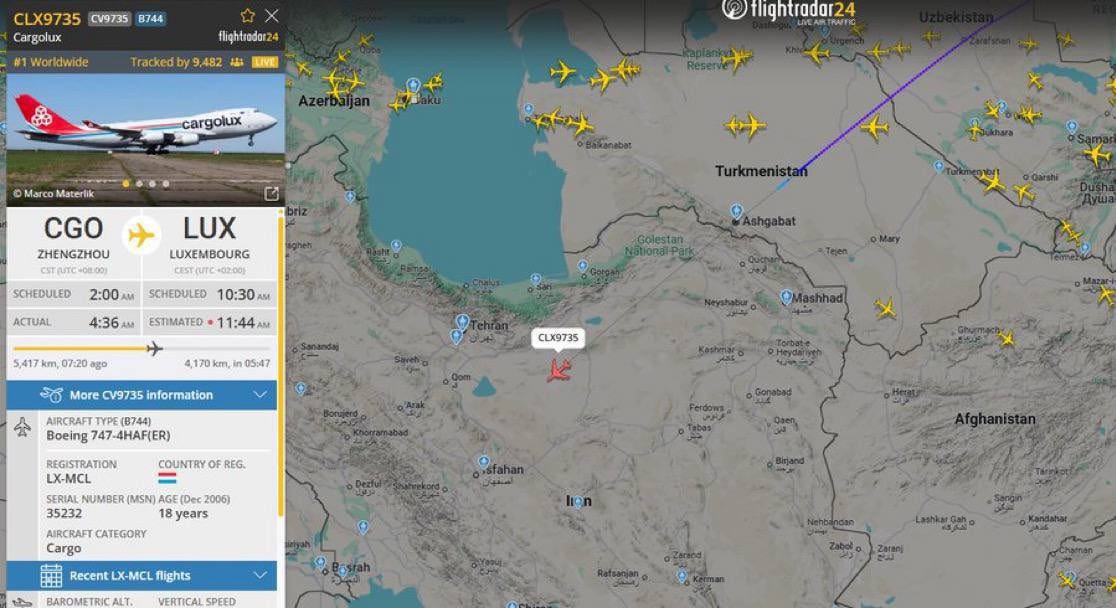

Adding another layer of complexity and international intrigue to the unfolding crisis is the reported arrival of a Chinese cargo plane in Tehran amidst the escalating conflict. While official details remain scant, the timing and nature of the flight have fueled speculation that Beijing may be providing military support to its strategic partner, Iran.

U.S. and allied intelligence agencies are undoubtedly scrutinizing this development. If confirmed to be carrying military hardware, it would signal a significant deepening of the China-Iran strategic partnership and a direct challenge to U.S. and Israeli efforts to isolate Tehran. For now, the contents of the cargo plane remain a matter of intense speculation, but its presence serves as a potent symbol of the shifting geopolitical alignments in the region.

Is This War "Good" for the USA? A Contentious Dialogue

The question of whether a conflict between Israel and Iran could, in any way, be beneficial for the United States is fraught with complexity and controversy. The overwhelming consensus among economists and foreign policy experts points to a resounding "no."

The economic downsides are stark and immediate. A surge in oil prices acts as a tax on American consumers, fueling inflation and potentially triggering an economic downturn. Supply chain disruptions and heightened geopolitical instability would further dampen economic growth and rattle financial markets. The risk of the U.S. being drawn into the conflict, either directly or indirectly, carries the immense cost of military expenditure and the potential loss of American lives.

However, a more cynical and realpolitik perspective, often whispered in the corridors of power, might identify some potential, albeit risky, strategic "advantages." A contained conflict that degrades Iran's military capabilities and sets back its nuclear program could be seen by some as a long-term win for U.S. interests in the region. A weakened Iran could have less capacity to fund and arm its proxy forces, such as Hezbollah and the Houthis, which have been a source of regional instability and a threat to U.S. allies.

Furthermore, a regional crisis can sometimes create opportunities for diplomatic leverage and a reassertion of American influence. The U.S. could position itself as the indispensable mediator, working to de-escalate the conflict while shaping the post-conflict security architecture to its advantage.

It is crucial to emphasize that these potential "upsides" are fraught with peril and based on a high-stakes gamble. The risk of a contained conflict spiraling into a full-blown regional war with catastrophic consequences is immense. The human cost of such a conflict would be tragic, and the long-term strategic blowback for the United States could be severe, potentially bogging it down in another protracted Middle Eastern quagmire.

The Road Ahead: De-escalation or a Darker Path?

The international community is holding its breath, hoping that calls for restraint will prevail. Diplomatic efforts are underway, with major world powers urging both Israel and Iran to step back from the brink. The coming days will be critical in determining whether these efforts succeed.

For the oil markets and the global economy, the uncertainty is the new certainty. Businesses and investors will be closely monitoring the rhetoric and actions of both nations. The prospect of a wider war, however remote it may seem to some, will continue to cast a long shadow over the economic landscape. The Ticker Talk will continue to provide our readers with up-to-the-minute analysis as this critical situation develops.